本周,GfK受IFA邀请参加Alibaba国际站主办的2021 IES(International Electronic Show,国际电子线上展),并携手战略合作伙伴IFA于2021 Technology Trends专区分享最新消费电子重点行业趋势。本次IES的特色主题涵盖智能家居、无线和可穿戴设备品和环保节能产品,为全球消费电子产业专业人士提供最新行业趋势分析及消费洞察等内容。

GfK中国家电研究总监李沫代表GfK在线上解读了2021年中国高端家电市场发展现状,聚焦行业发展趋势、产品创新与消费者洞察。

以下为演讲实录

Hello everyone, I’m from GfK China as the Research Director of Home Appliance. I’m glad to be entrusted by IFA to share with you the latest developments of China’s home appliance market. And thanks for Alibaba’s invitation.

GfK and IFA have had a decade-long partnership serving the Consumer Electronics Industry and last year we have renewed and extended our global partnership at IFA Berlin. We share the joint mission to inject growth into the CE industry globally, including China. In the future, we will transfer valuable knowledge to the market through more forms of cooperation.

Today, I will share with you the development trend, product trend and consumer insight of China’s high-end home appliance market.

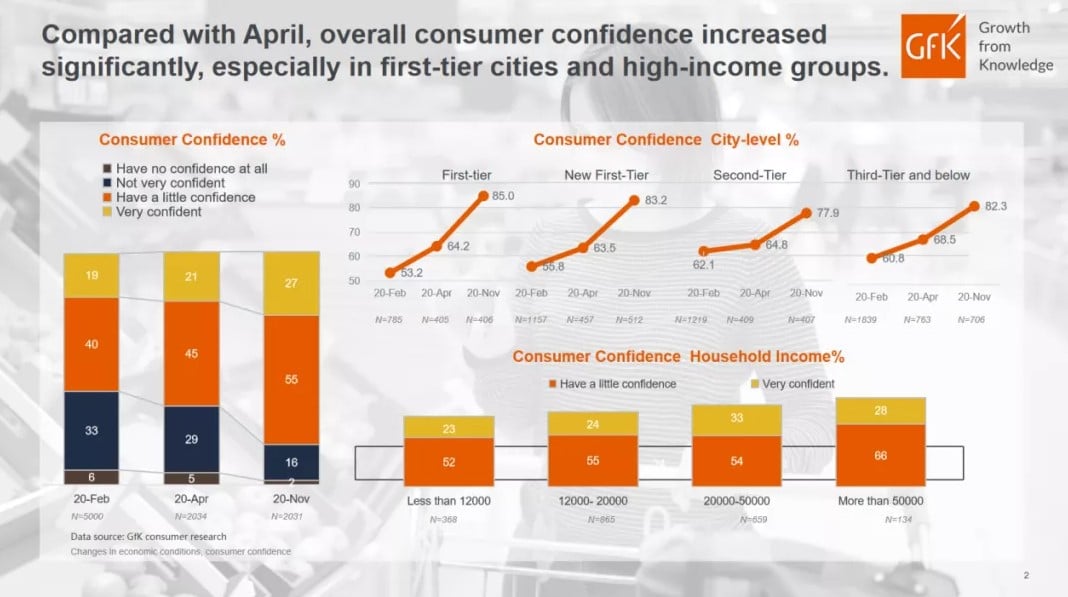

2020 is a very special year. The COVID-19 has changed our way of life and work, as well as the consumer demand and the retail market. Since last year, GfK has conducted three consumer confidence surveys. These surveys were held on February when the epidemic was the most serious, on late April when the epidemic was basically under control, and at the end of November of last year. Comparing the results, we could see the changes in consumer confidence, and these changes would also have impact on the trend of market demand, so it is meaningful for us to know consumers.

With the recovery of economy and consumer confidence, the consumption of high-income people drives the rapid growth of premium home appliance market, GfK has released the report with the topic of premium trend of home appliance market. Today we will share some of the main contents of this report with you.

First of all, let’s look at the changes of consumer confidence. Consumer confidence fell to a low point in February and April. However, a good trend showing that from the situation in November, consumer confidence has recovered very quickly and has returned to the normal situation. More than 80% of consumers are very confident about future consumption. From the perspective of city tier, the consumer from the tier one cities and new tier one cities, their confidence has recovered faster, and it would drive consumption better. As for the household income, people with higher income, such as those with income of more than 20,000 or 50,000, are more confident in future consumption.

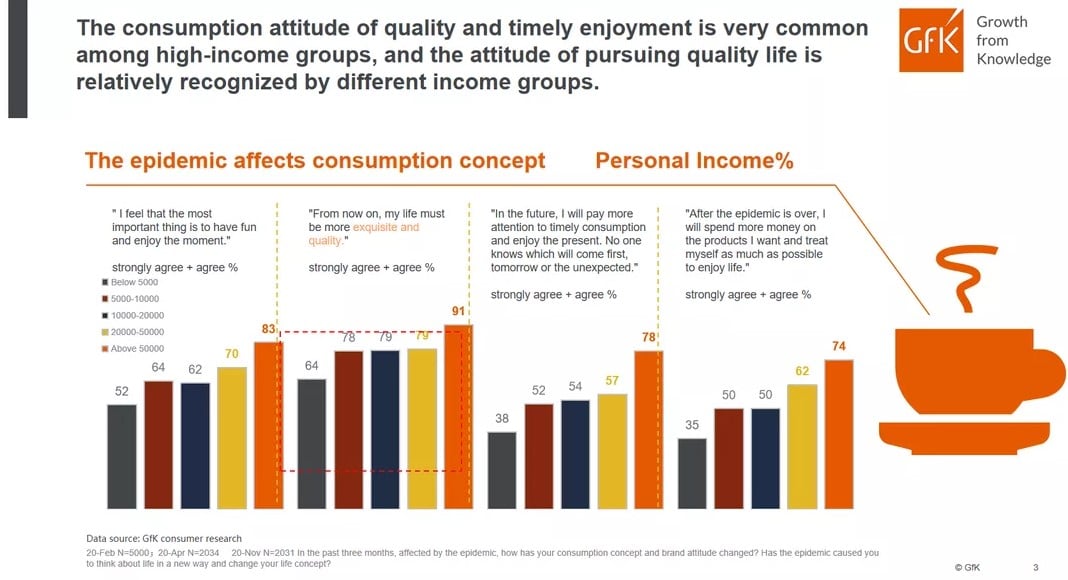

Regarding the consumers’ attitude, after being through the epidemic, the attitude generally accepted by consumers is that “my life must be more exquisite and with quality in the future”, and the high-income group has the highest recognition portion; at the same time, the higher income group also pay more attention to timely consumption, enjoying life and rewarding themselves.

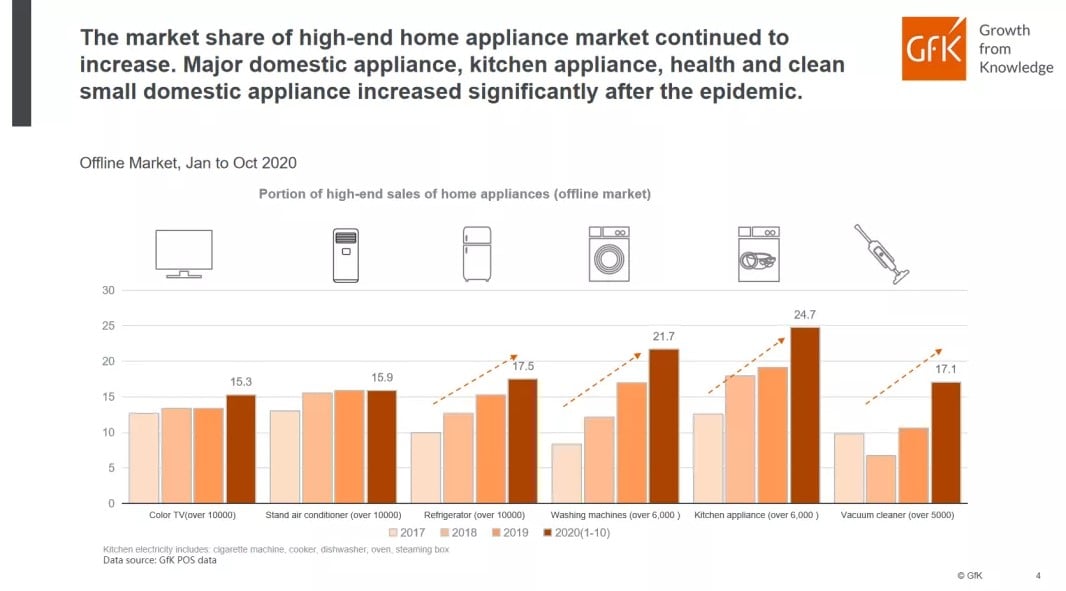

The enjoying better life attitude will also have influence on retail market. According to GfK retail data, from 2017 to 2020, the sales portion of high-end home appliances have a significant increase, such as TV, air conditioner, refrigerator above 10K CNY, washing machine and kitchen appliance above 6K CNY, and vacuum cleaner above 5K CNY. Moreover, due to the stay home mode and the emphasis on health bring by the epidemic, kitchen appliance and cleaning small domestic appliance performed outstanding.

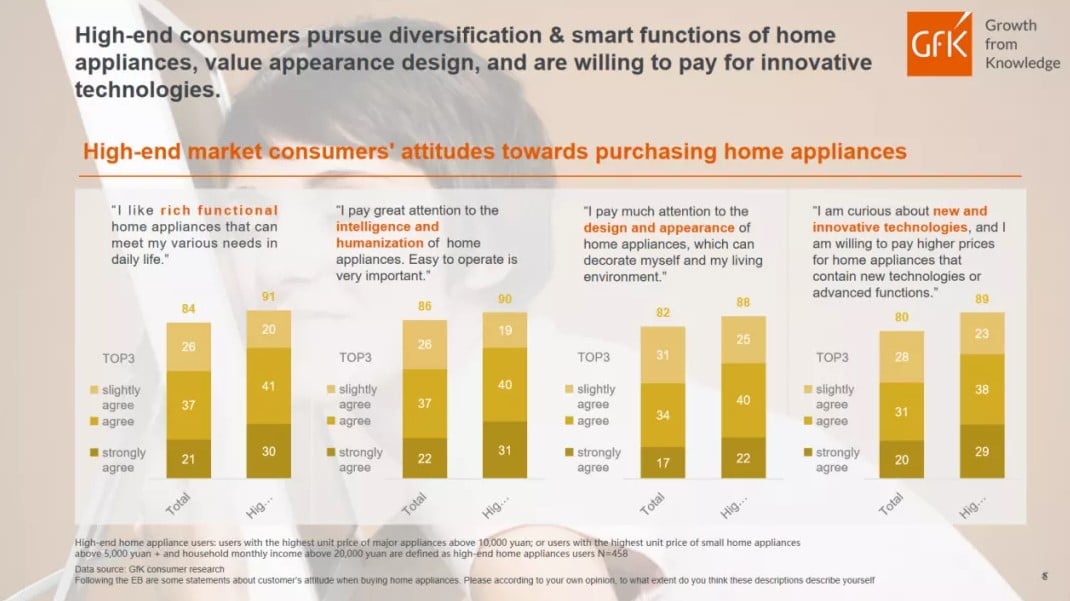

Next, let’s take a look at the product features or selling points that consumers more care about. First of all, consumers attach great importance to the design and appearance of home appliances, especially the premium market users, who pay more attention to the appearance design than the overall users. Secondly, the curiosity of new technology and innovative technology is key driving force for them to buy high-end home appliances, as well as intelligence and convenience, which are the mainstream of home appliance industry. Besides above points, using richer functions to meet the needs of people’s daily life are also the key to promote the development of high-end home appliances.

Therefore, based on the understanding of the industry and the survey results, GfK summarizes the four trends of high-end home appliances:

The first is artistic appearance design. We can see a lot of new products with different materials, different designs to make home appliances more eye-catching. Creative innovation such as new category, new fusion products or function, is the second one. The third one is the core technology and function. The core technology is driving the development of industry or product. Of course, intelligent interaction is indispensable, which has become the mainstream in the high-end home appliance market. We see that many manufacturers already treat AI or intelligence as the core trend.

pic

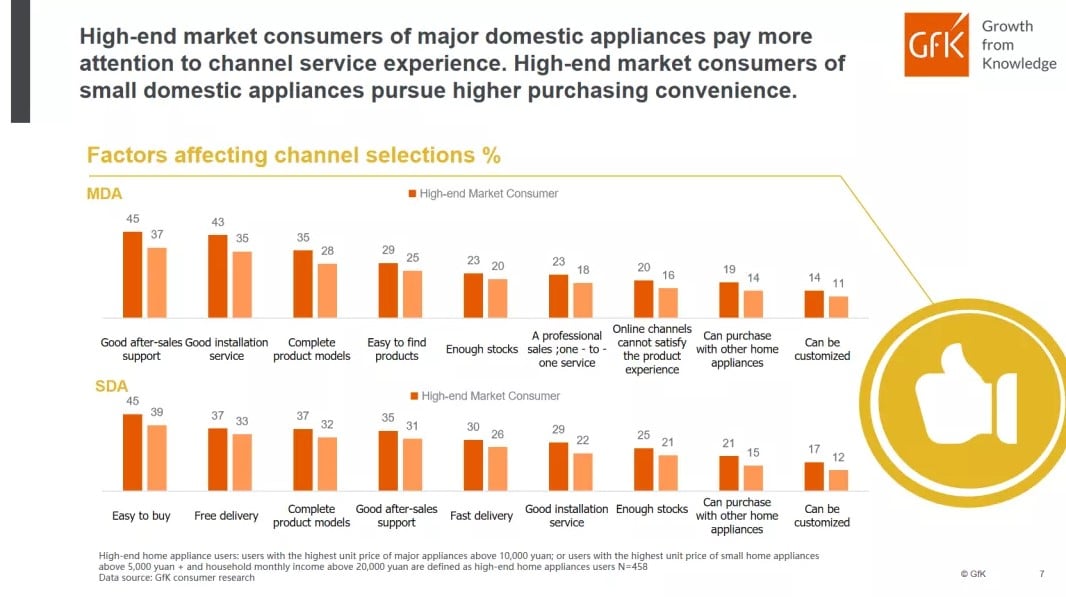

Finally, we will talk about consumers’ selection of channel. In 2020, due to the epidemic, online market has developed very rapidly, and the contribution of online market has exceeded offline in many categories. “Does it mean that offline have no chance?” In fact, if we see the trend of high-end home appliances, we can see that offline still have opportunity. Because people attach great importance to offline shopping experience and professional service, especially for premium market consumers. As for major domestic appliances, offline still play important role, the after-sales service, installation and in-store experience are the key consideration factors for premium market consumer when purchasing major domestic appliance. But for small domestic appliances, it is a different story, because there are too many categories and models in small domestic appliance market, and its distribution is usually limit in offline, on the contrary, online has richer choice, it is more convenient and easier to find and search for premium market consumers.

That’s all for my today’s sharing, you could scan the QR code to download the complete report if you are interested. For more reports, please follow GfK China WeChat official account.

Thanks Alibaba for providing this exchange platform, and thank IFA for its support. Thank you for watching!